27.07.2020

Schuldschein market sees trend towards sustainability

- A total of EUR 4.6 billion in Schuldscheine (SSDs, German promissory notes) were placed in Q2 2020

- Strong investor demand despite Covid-19

- Spreads currently tighter again, but still at a historically high level

- Increase in green issues and notes with interest rate linked to ESG indicators

Schuldscheine with a total volume of EUR 4.6 billion were placed by 18 issuers in the second quarter. Both the volume and number of issues were considerably smaller than in the same quarter of 2019, but on a par with the previous two quarters. Every SSD transaction that came to market was oversubscribed, and in some cases the buoyant demand meant that the order book was closed early. The share of green issues and ESG-linked Schuldscheine (notes with coupons linked to environmental, social and governance indicators) continued to grow.

"We have made sure that the Schuldschein market remained open for customers with good credit ratings, even during the lockdown in Germany"

Dieter Kemler

Member of Helaba's Board of Managing Directors

"We have made sure that the Schuldschein market remained open for customers with good credit ratings, even during the lockdown in Germany," stressed Hans-Dieter Kemler, a member of Helaba's Board of Managing Directors. As one of the leading SSD banks, Helaba was able to successfully place a number of German and international transactions during this period. While spreads on the bond market literally shot up, especially at the onset of the crisis, thanks to its lower volatility the Schuldschein market managed to hold its ground. Although premiums on new issues in both segments have meanwhile come down again, they remain at a slightly higher level than before the outbreak of the pandemic. "There is no doubt that some issuers have postponed transactions. For the second half of the year, our expectation is that the solid performance will be sustained," said Kemler. According to him, this view is also supported by the fact that, towards the end of the second quarter, as many as 11 SSDs had already entered the marketing stage and are set to be valued in the third quarter.

Growing importance of sustainability

One trend that has become very clear is the growing importance of sustainability in the Schuldschein market. In the first half of the year, total issuance of sustainable SSDs amounted to approximately EUR 1.6 billion. Helaba is one of the leading arrangers in this market segment, too, and in the first half of 2020 supported transactions by EVN Energieversorgung Niederösterreich AG and Schaeffler AG, among others.

The recently issued ESG-linked Schuldschein of Aurubis AG is further evidence that this trend is continuing unabated. The Hamburg-based company placed a volume of EUR 400 million with institutional investors and, for the first time, included a sustainability component in the financing. In this way, the interest rate of the SSD's coupon is directly linked to the company's sustainability performance, based on the ESG rating provided by the independent and recognised rating agency Ecovadis. In this way, Aurubis has become a trailblazer within the sector and is the first-ever company within the raw materials industry in Germany and Europe to place this kind of ESG-linked SSD - a Schuldschein with a green component.

Helaba supported the transaction, which met with considerable interest despite the turbulence on the financial markets due to the coronavirus pandemic. In view of the brisk demand and the fact that the issue was considerably oversubscribed, it was possible to achieve an optimum maturity profile. In addition, the price was fixed at the lower end of the marketing range.

Thomas Goerdt, Head of Corporate Treasury at Aurubis AG: "By linking our interest costs to our ESG performance, we are sending a clear message to all our stakeholders: that we consider sustainable, responsible action as being consistent with the long-term success of our business. Helaba has been a source of encouragement to us in pursuing this venture and has provided us with wide-ranging support in structuring the sustainability component".

Kemler concludes by adding: "For some time now, we have been observing an increasing shift towards sustainability on the part of our customers. By offering our sustainability-focused financial products, we are able to support our customers in embracing this trend and thereby also fulfil our own high standards".

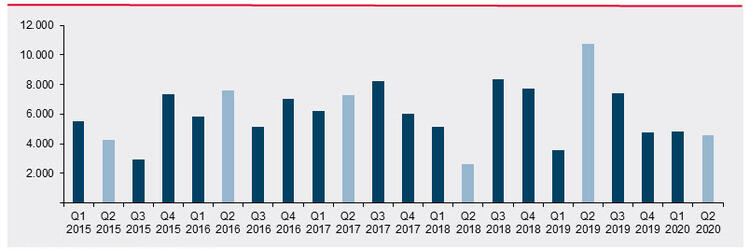

Issuance volume in Q2 on par with first quarter

Valued Schuldschein issues by volume (in EUR millions)

Source: Helaba Research

Capital Markets

The Capital Markets division is an efficient and reliable partner for savings banks, corporates, institutional clients and the public sector.

Sustainability

Ecological and social responsibility is an integral component of our business strategy.

More News

- 08.02.2024First time ever: Helaba and vc trade achieve complete digitalisation in the Schuldschein market

First time ever: Helaba and vc trade achieve complete digitalisation in the Schuldschein market

- 17.12.2021Largest-ever ESG-linked Schuldschein issued by non-German company

Largest-ever ESG-linked Schuldschein issued by non-German company

- 21.02.2019Helaba arranges Schuldschein for Fraport exclusively on vc trade

Helaba arranges Schuldschein for Fraport exclusively on vc trade

- 18.12.2018For first time, Helaba arranges EUR 700 million Schuldschein in line with LMA standard

For first time, Helaba arranges EUR 700 million Schuldschein in line with LMA standard

- 17.04.2018Helaba successfully places green Schuldschein of Verbund AG using vc trade

Helaba successfully places green Schuldschein of Verbund AG using vc trade