Catching the wind

Financing offshore wind power

Inhalt

Mr. Seibel, you are an industrial engineer. What are you doing at a bank, of all places?

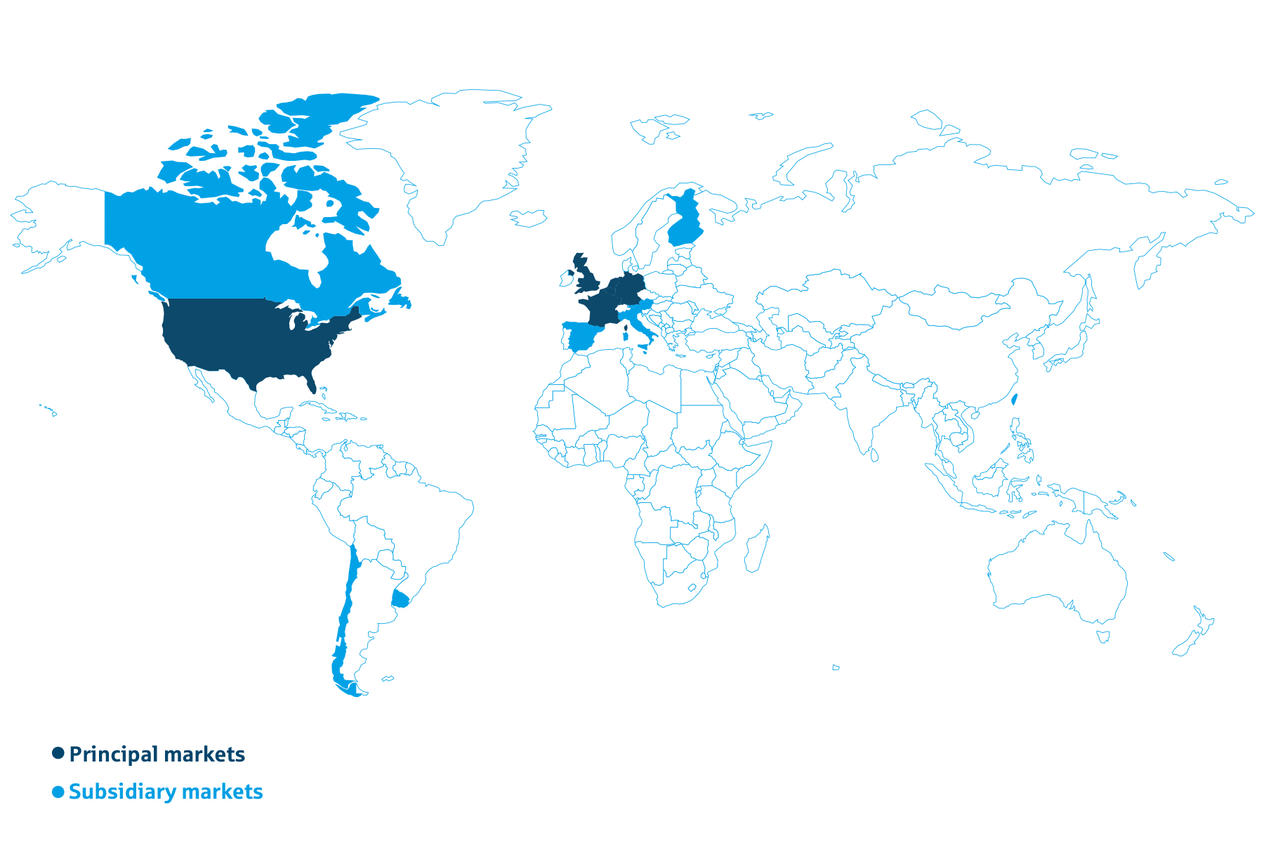

Our team helps energy suppliers, special funds and project developers to finance infrastructure and energy projects all over the world. The transactions involved are highly complex and require extensive knowledge of international law as well as the relevant technical and financial expertise. We therefore have business administrators, lawyers, tax experts and engineers like me working together on our transactions.

16

Helaba currently has 16 offshore wind power projects in its portfolio. (as of March 2021)

One of your most recent financing deals was the Fécamp offshore wind farm in Normandy. How do you choose a project like this?

We helped to finance the first offshore wind farms in 2012, and since then we have accumulated a wealth of expertise. The project in France involves finance amounting to € 2 billion, of which we are providing € 70 million. All kinds of variables play into our decision-making but the companies behind the project are obviously a key factor. The partners for the Fécamp project are EDF Renewables, which is one of the biggest energy utilities in France, Enbridge Inc., one of the leading North American energy infrastructure companies, and offshore wind power pioneer wpd off-shore. The project offers considerable security too because the electricity price is guaranteed for 20 years by the French government. We look very closely at the technologies to be used too. The turbines in this case are being supplied by Siemens Gamesa – the involvement of such a reliable and technologically outstanding company is always a very good sign.

Stefan Seibel

How big is the wind farm?

The facility encompasses 71 turbines, which will stand between 13 and 22 kilometres off the coast of north west France, and is expected to generate around 500 megawatts of electricity from 2023. This will be sufficient to meet the electricity requirements of over 60 percent of the population of the Seine-Maritime region – that’s 770,000 people.

Those are big numbers. Has the technology reached its limits yet?

The amount of power produced depends to a large extent on the length of the rotor blades. Blades of over 100 metres in length are already in use and extending them by an additional ten metres, for example, could push up the yield by around 20 to 25 percent. This will be no mean feat in engineering terms but the general feeling is that a figure of up to 20 megawatts per turbine should be possible – and concrete plans are already being drawn up for units rated up to 15 megawatts.

What challenges do you foresee for the renewable energy sector?

Generally there has not been enough progress made on expanding the grid or on the possibilities for storing electricity from renewable sources. It is becoming increasingly difficult to install new onshore wind turbines too because people do not want to see them where they live and because of concerns about possible harm to habitats and wildlife. This makes offshore a very good alternative.

What motivates Helaba to invest in renewable energy?

Three main reasons underpin everything we do in the sustainability arena. Firstly, failing to support green projects would put us at a competitive disadvantage. Secondly, these projects earn us a healthy profit and thirdly, we as an organisation see it as part of our role in the world to promote environmental, social and corporate governance activities and in the process to make our operations more sustainable. This combination of motivations makes for a strong – and ultimately compelling – case in favour.

Sustainability at a glance

Sustainability at a glanceSustainability at a glance

An overview of important aspects of sustainability at Helaba.

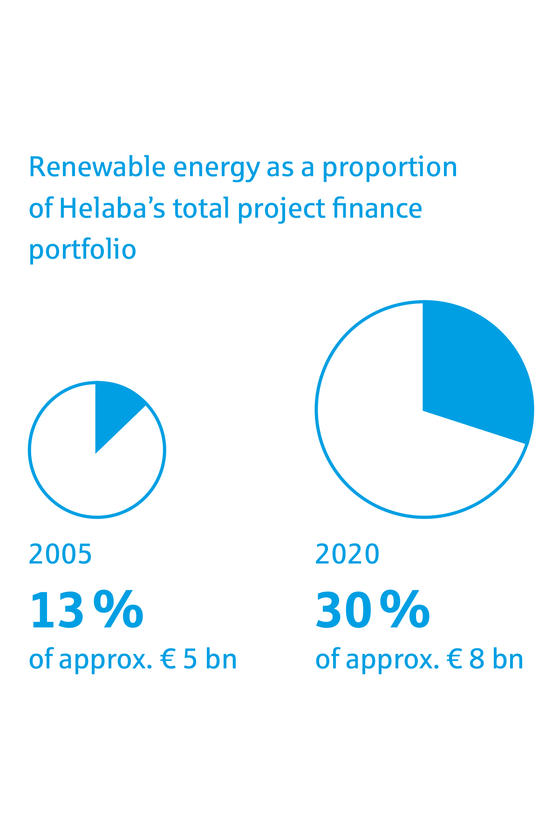

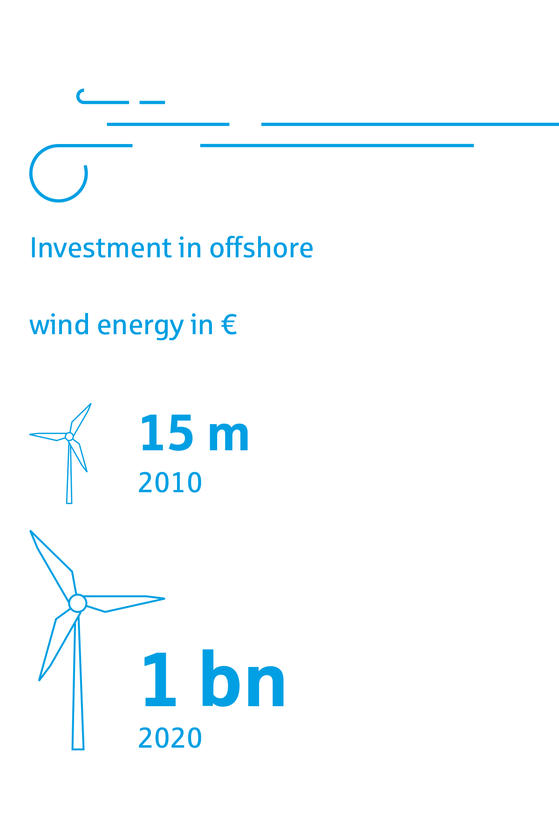

Renewables

Helaba has sealed more than 100 transactions in the renewables field since the late 1990s, 70 percent of them wind power projects, and renewable energy currently accounts for € 2.3 billion of Helaba’s portfolio. Initially, the Bank had just two individuals working on renewable energy project finance. Now, though, the team comprises four colleagues in Frankfurt, four in London and four in New York. The sustainable investments field as a whole has also grown rapidly during this period, especially over the last few years, and has been a significant source of income for Helaba since 2007. The Bank invests up to € 100 million in this area in the “Final Hold” category, in which it retains its stake long term. The amount invested in the underwriting category, in which Helaba subscribes for shares in a larger financing arrangement that it then sells on over the course of the first three years, can reach as much as € 300 million. Helaba’s profit from these activities comes from the processing fees for the investors who acquire a stake in the projects and from interest margins, which depend on risk and the term of the loan.

Further Stories

Opening doors

Opening doorsOpening doors

When customers need support to access markets in non-OECD countries, Ralf Schuster is on hand to assist – with marketing concepts, contacts and ideas. Gaining an edge through diversity

Gaining an edge through diversityGaining an edge through diversity

Diversity in the business model and diversity in the workforce have the same basic idea. An interview with Helaba's CEO Thomas Groß.